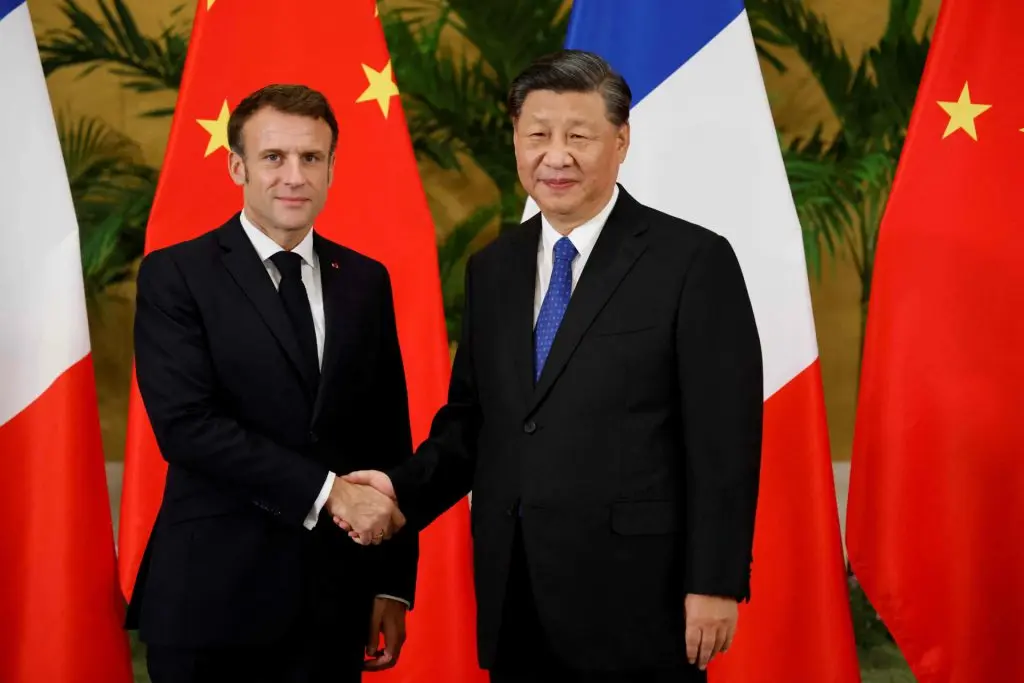

Cetoex News – France is looking to attend the upcoming BRICS summit in South Africa, Johannesburg in August. French President Emmanuel Macron expressed his interest to attend the summit hinting that the country wants to end reliance on the U.S. dollar. Macron repeatedly made controversial remarks early this year targeting the U.S. dollar’s supremacy on the global stage. The President called for Europe to rethink its dependence on the USD calling the currency a “great risk”.

Macron stressed that European countries must not “get caught up in crises that are not ours”. The President refers to the dollar’s debt as a major crisis that could hamper all countries that keep the greenback as reserves.

However, the BRICS alliance is yet to approve Macron’s interest to attend the upcoming summit. Russia is against France being a part of BRICS citing that the Macron administration wants internal details of the alliance and sabotage the soon-to-be-released currency.

In addition, the BRICS influence is growing in Latin America as Argentina sidelined the U.S. dollar for imports. Argentina carried out 19% of its overall imports by paying the Chinese Yuan and not the U.S. dollar. A total of $2.72 billion was settled in cross-border transactions with the Chinese Yuan giving the USD a miss.

In another significant shift, Pakistan settled trade for Russian oil imports by paying with the Chinese Yuan. The U.S. dollar took a back seat in all of these international transactions signaling that BRICS is stronger than expected.

BRICS Takes on the U.S. Dollar With the Chinese Yuan

The Chinese Yuan is the most commonly used currency for international trade than the dollar. A handful of countries have expressed interest to join the BRICS alliance and accept the new currency. The expansion from BRICS to BRICS+ could be decided in the next summit making the bloc financially stronger.

The overall BRICS+ GDP would reach $32.66 trillion if the expansion goes through. The estimate is $7.16 trillion ahead of the United States GDP which is at $25.5 trillion. Therefore, the dollar and the American economy stand at a risk of collapse if the BRICS currency gains strength in the international markets.

NEWS BY – CETOEX NEWS