Cetoex News – We are mere hours away from the Fed’s releasing its interest rate hike and Chairman Jerome Powell hosting the FOMC press conference. In 2022, these events brought about a certain level of concern for the Bitcoin and crypto markets. With the objective to curb inflation, the Federal Reserve continued to raise interest rates throughout the year. Hence, most risk assets including crypto took a nose dive.

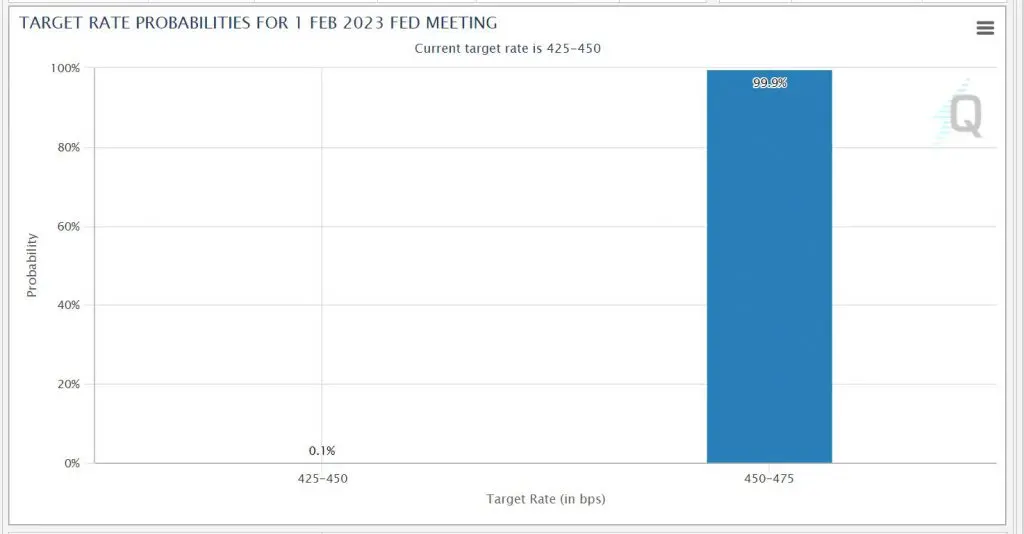

Right now, the collective sentiment is rather positive. According to data from CME, the current probability of the interest rate rising by 25 BPS is 99.99%. Now, by all means, Powell’s speech after the interest rate release should be dovish. That would technically mean the possible use of Quantitative easing while relaxing the interest rates going forward. A brilliant bullish scenario for Bitcoin and co.

Yet, the market is expecting Powell to sound hawkish. As mentioned above, from the beginning, his objective has remained to curb inflation. The chairman’s priority remains to push a 2% inflation target, and not assist SPX’s recovery. Therefore, at the moment, it seems equally balanced. 25 basis points with a hawkish view should neutralize the overall Bitcoin movement, right?

Not really.

Other important factors to consider

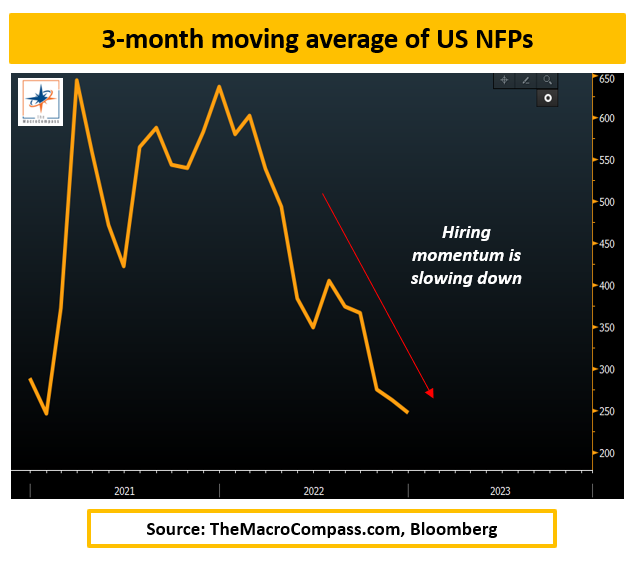

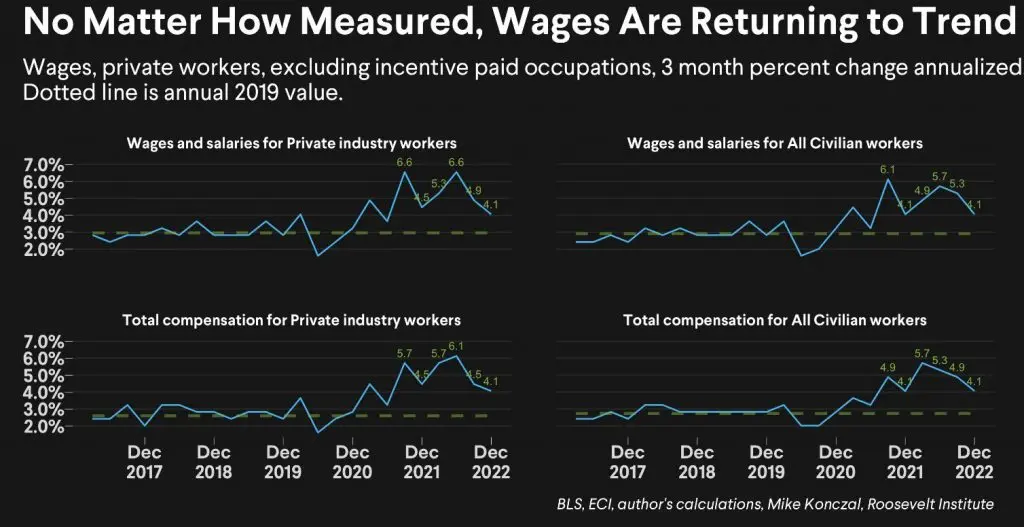

Now, there is a reason why there is a 99.99% probability of 25 BPS today. It is because the labor market is drastically slowing down. The 3-month moving average of US Non-Farm Payrolls has significantly dropped, indicating the process of hiring has reduced. A majority of temporary jobs are getting slashed as well, and that is synonymous with lower nominal wage growth at press time. The market is rapidly going back to pre-2021 levels.

Alongside the above factor, the core assumptions are that now inflation pressures are becoming less broad. Hence, there is more breathing space for the Feds. However, outrightly stating that in the public, means that the bond markets would explode. The best case scenario for the Fed, for now, is still to keep the ‘fear’ and ‘rates higher for longer’. This is obviously, not the best-kept secret, and over time, the markets will become bullish again.

How do Bitcoin, Ethereum react after FOMC now?

The overall market expects CPI to drop down to 3% in 2023. If that doesn’t shout bullish for digital assets, nothing else will. However, at press time, and right after FOMC, volatility should be expected.

The best case scenario for Bitcoin post-FOMC is a re-test at $22,400 before shooting above $25,000 and continuing on its upwards trajectory. However, BTC’s rally since January is overheating at the moment, and more corrections should follow the asset. A bearish divergence is forming between RSI and BTC(yellow dotted line) which is another signal. A worst-case scenario would mean Bitcoin dropping down between $20000-$21250, before marching forward again.

For Ethereum, the idea remains more or less the same. A key resistance is ominous at $1655, but once the altcoin moves past this range, reaching $1800, then above $2000, will be a routine rally.

Overall, unless any other external factors disrupt the markets, the bulls are coming for Bitcoin and Ethereum. Sooner or later.

NEWS BY – CETOEX NEWS