Cetoex News – Following the surge prompted by institutional interest in cryptocurrencies, Bitcoin [BTC] has been exhibiting limited movement within a tight trading range of $28,000-$31,000. This consolidation could be attributed to various factors. The primary reason is the growing interest in altcoins. Ripple’s partial legal victory sparked heightened interest in altcoins, causing BTC to take a backseat in the market. Consequently, this has led to a notable decrease in the volatility of the leading crypto.

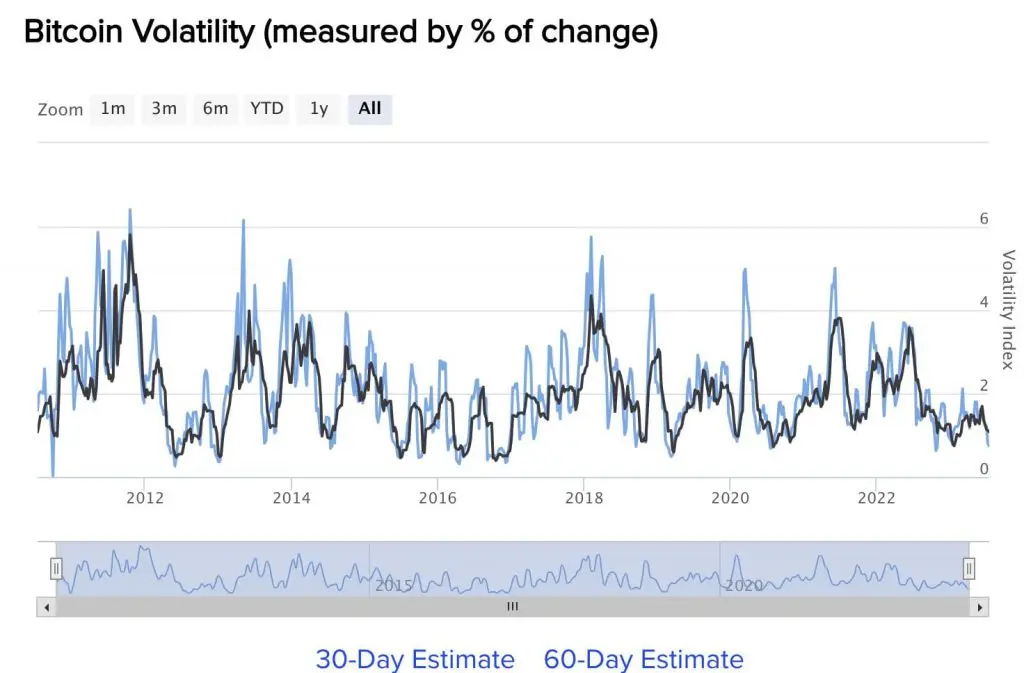

According to data from 99Bitcoins, the 30-day estimate for Bitcoin has dropped to only 0.74%. This is the lowest realized reading for Bitcoin since Jan. 16, when it was at 71%.

Furthermore, Greeks Live, the crypto derivatives analytics firm, has noted that the volatility index for both BTC and Ether has hit a multi-year low of 37%. The DVOL [Deribit Implied Volatility Index] algorithm has also observed that the current implied volatility level is at the lowest in the history of the cryptocurrency market. This suggested that derivatives traders are not hopeful about substantial price fluctuations in the Bitcoin market in the short term. They anticipate the continuation of low volatility. Greeks Live further said,

“It is an indisputable fact that the overall volatility of crypto is declining, which will inevitably force the implied volatility of crypto to keep going to new lows.”

Bitcoin’s trading activity takes a backseat

The decrease in volatility can also be attributed to the decline in Bitcoin’s trading activity. The dip in volatility was primarily caused by reduced trading activity and an inclination among investors. According to a recent update from Glassnode, BTC deposits to centralized exchanges have reached a three-year low. This further noted a slowdown in trading activity.

Although viewed as a positive sign due to the reduced selling activity, the decline in deposits may also suggest a slowdown in buying activity.

Will FOMC take Bitcoin out of this price rut?

Throughout history, macroeconomic activities have consistently demonstrated their impact on the Bitcoin market. Individuals expect that the upcoming FOMC meeting will have a similar effect. Experts speculate that the U.S. Federal Reserve may increase interest rates by 25 bps this time. This comes after a pause in the hike cycle in June. As a result, the community believed that the current stagnation in Bitcoin’s performance might be disrupted. The imminent rate hike could provide the asset’s trajectory with some clarity and direction. Analysts believe that it would be a downward trajectory for Bitcoin. Prominent crypto analyst, Michaël van de Poppe revealed that “lower scenarios is the case for Bitcoin.”