November 16, 2024 – Nvidia’s (NASDAQ: NVDA) stock continues to soar as Citigroup analysts raised their price target for the tech giant, citing expectations of a massive $4 billion earnings boost. The revised target reflects Nvidia’s dominance in the artificial intelligence (AI) and semiconductor markets, fueled by growing demand for its cutting-edge graphics processing units (GPUs).

Citi’s Revised Price Target

Citi analysts increased Nvidia’s price target from $650 to $750 per share, underscoring confidence in the company’s ability to capitalize on the AI boom. The report highlights Nvidia’s leading position in AI-driven computing, bolstered by strong adoption of its GPUs in data centers and cloud infrastructure worldwide.

“The ongoing AI revolution is driving unprecedented demand for Nvidia’s products,” the analysts noted. “We anticipate a $4 billion incremental boost to Nvidia’s earnings, which is poised to set a new benchmark for growth in the industry.”

Key Earnings Drivers

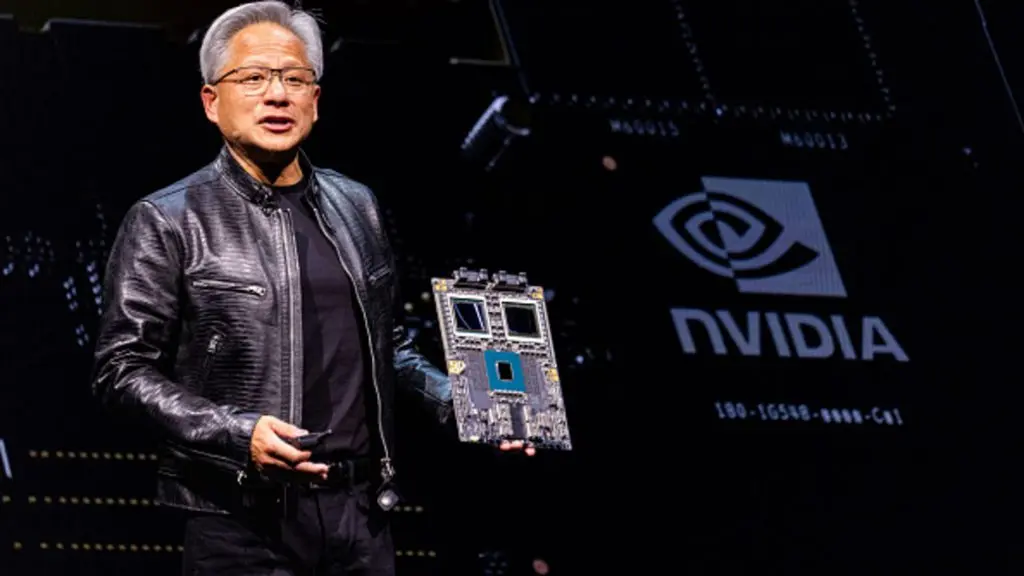

Nvidia’s upcoming earnings report is expected to reflect a surge in sales of its H100 and A100 chips, both critical components for AI applications. These high-performance GPUs are increasingly deployed in generative AI systems and large language models, including OpenAI’s GPT and similar technologies.

Additionally, Nvidia’s partnerships with major tech firms and cloud providers are expected to play a pivotal role. Companies like Microsoft, Amazon Web Services, and Google Cloud are heavily investing in AI, relying on Nvidia’s hardware to meet their computational needs.

Broader Market Impacts

The upgraded price target comes as Nvidia shares have already gained over 200% year-to-date, making it one of the best-performing stocks in the S&P 500. The company’s market capitalization recently surpassed $1.3 trillion, placing it among the most valuable companies globally.

Despite the optimism, some analysts caution that Nvidia’s valuation might be stretched. However, Citi remains bullish, emphasizing the company’s robust earnings potential and its integral role in shaping the future of AI.

Read This : Cetoex Made Easy 8-Step Guide to Buying Crypto.

Investor Outlook

The raised price target and projected earnings boost have reinvigorated investor interest in Nvidia, with the stock seeing increased trading volume following the announcement. With its Q3 earnings report scheduled for next week, market participants are keenly watching to see if Nvidia can deliver results that align with these elevated expectations.

As Nvidia solidifies its position at the forefront of AI innovation, its stock performance and financial health will remain under the spotlight. Analysts believe the company’s growth trajectory is far from over, making it a key player in the rapidly evolving tech landscape.