Cetoex News – In mid-July, Shiba Inu initiated a downtrend that lasted for nearly a week. From a high of $0.00000853, the asset’s price dropped by 11%. Upon reaching $0.00000756, SHIB started consolidating within a narrow range. Over the past few days, it has been attempting to collect liquidity.

Without enough momentum in the market, the price continues to remain stagnated. Post registering a 0.5% rise over the past day, SHIB was seen exchanging hands at $0.00000788 at press time.

SHIB Addresses with Holdings Rise

Along with the short-term woes, Shiba Inu’s performance on the longer timeframes has also been lukewarm. Over the past month, the asset has appreciated by merely 4%. However, this lackluster performance has not stopped Shiba Inu investors from joining the network. Except for one category, most other address clusters have registered an uptick.

Shiba Inu investors holding up to 100 million SHIB tokens have risen in the 2.6% to 4.6% bracket. Likewise, addresses possessing 100 million to 100 billion SHIB have increased by 0.2% to 1.4%. The largest rise was registered by 100 billion to 1 trillion clusters. They have jumped by 8.8% over the past month. At press time, a total of 507 addresses belonged to this category.

Whales holding 10 trillion to 100 trillion SHIB have reduced in number by 21.4%. At press time, there were 11 addresses belonging to this category recognized by IntoTheBlock. Alongside, there was just 1 address that possessed more than 100 trillion SHIB, leaving this category unchanged.

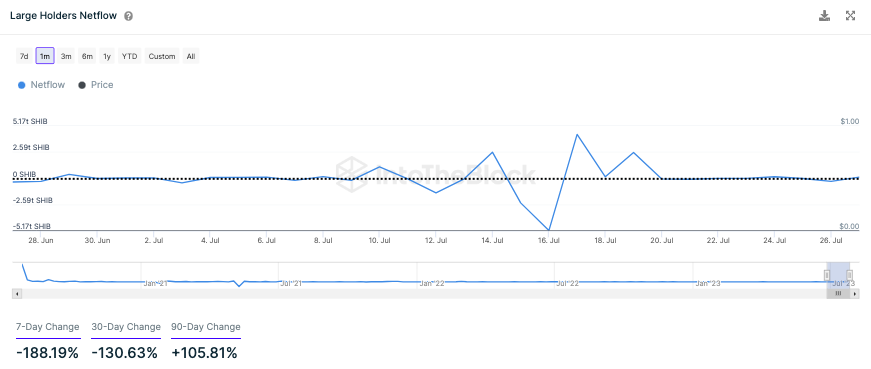

Even though most clusters have seen more addresses added, it should be noted participants have not been indulging in a lot of SHIB buy-side transactions. In the last 30 days, large holders’ [addresses possessing at least 0.1% of the SHIB circulating supply] net flow has dropped by 130%.

Over the past week, this metric has been hovering around the neutral zone, justifying why SHIB continues to consolidate despite the address influx.